Share this Post

Any investor will tell you that before you choose to invest it pays to do your research. While many investors opt for property or stocks some choose to invest in gold or diamonds. Gold might seem the more secure or popular investment route – but in fact diamonds (specifically fancy coloured diamonds) are historically a much better investment.

Gold is a traded commodity and its value is based on the whim of investors and the supply and demand on the global market – therefore you cannot guarantee that your investment in gold will appreciate over time. Whereas diamonds are unique and have numerous attributes on which their value is calculated (gold is not unique).

Gold, unlike diamonds, is not scarce. In fact, there is an over-supply of gold. Most people think of gold and its use in jewellery and objets d’art. While there are a few industrial uses for gold, in essence gold is a static investment. Unlike an investment in a company that produces a product that sells something, gold inherently doesn’t produce anything.

When thinking of a long term investment one word can describe an investment in gold: terrible. When gold prices rise it often garners a lot of media attention and people scramble to purchase – but less widely reported are the crushing falls the value of gold has experienced. A 2011 New York Times article stated that the return on gold from the years 1836 to 2011, when inflation was factored in, was just 1.1%. It is also extremely volatile. The ups and downs of gold are similar to the stock market but without any of the returns. So while gold attracts certain popular (erroneous) attention about being a solid investment, its long-term results are some of the worst an investor could experience.

Gold can also be a challenge when it comes to transport and storage. When owning physical gold you need to factor in that you can’t just use FedEx or a normal courier company to take physical possession of your gold – and paying for a high secure company to deliver your gold can be very expensive. Then, once you take possession of your gold you need to store it. Gold bars can take up significant room and you will need to source a professional secure location in which to store them – all of this adds up and increases the cost of your investment.

Gold is also not a good hedge against inflation. While during times of crisis gold prices tend to rise, it is not a good hedge against regular, long-term, inflation. Between 1980 to 2002 gold lost a third of its value whereas inflation during this same period was up, per year, approximately 3.9%. So while gold fell to a third of what it had been in 1980 the price of goods had doubled.

The good news is that fancy colored diamonds are a much better investment.

Unlike gold, which has to be reported in tax filings, there is no requirement to report diamond purchases. Therefore an investor is able to invest in diamonds privately without the government knowing. Nor is your bank going to ask if your investments in your diamonds has increased in value over the year, but gold investors will be asked. And when you purchase gold an average investor is required to go through a broker to make a purchase – whereas with fancy colored diamonds the investor can purchase directly from a dealer.

Fancy colored diamonds are also much easier to transport. Most diamond purchases can be couriered to your location (with full insurance) via FedEx. Also, storage is most definitely easier with diamonds. Small and virtually indestructible diamonds can be stored in any secure location – from a safety deposit box to a home vault, diamonds can be kept with little to no cost incurred.

Diamonds are also an attractive investment because they can be put to use as they age and gain value. Many investors choose to incorporate their fancy colored diamonds into beautiful pieces of jewellery to wear. Wearing your investment will not affect the value of the diamond at all, in fact incorporating a diamond into a piece of jewelry might increase its value.

There are also a wide variety of fancy colored diamonds to choose from. Some of the best investments are pink diamonds (they were the highest performing hard asset of the past decade). An attractive aspect of investing in pink and other fancy colored diamonds is that they are not affected by external environments and bubbles in their market don’t take place. Rebecca Foerster, the president for North America at Alrosa PJSC, said that prices for pink diamonds have risen 300% in the past decade. The value of the pink diamond is likely to increase as the world’s leading diamond mine in Western Australia, the Argyle Mine run by Rio Tinto, which produced 95% of the world’s pink diamonds, closed in 2020.

It is important to research the basics of diamonds and work with a reputable dealer. Many aspects that make diamonds valuable are not seen by the naked eye – in fact, two diamonds can look nearly identical yet if one has a miniscule flaw it can drastically affect the value of the diamond. So making sure you are educated on diamonds is crucial.

The basics of diamond valuation are the ‘Four C’s’ which stand for Color, Clarity, Cut and Carat:

Color – In the world of fancy colored diamonds there is a wide range of colors – and they account for less than 0.1% of the number of mined diamonds annually. The rarity of fancy colored diamonds makes them highly sought after and drives up the price. The rarest colored diamonds are of the red and pink variety.

Clarity – Each diamond is unique and can include individual characteristics called ‘inclusions’; each diamond needs to be closely inspected to determine the number and position of inclusions to establish its clarity.

Cut – Perhaps the most well-known of the 4 C’s, the cut of the diamond greatly affects how it interacts with light and therefore its brightness and sparkle.

Carat – The carat weight is a term of measurement for how much a diamond weighs.

You also need to make sure that your diamonds are GIA certified. GIA stands for the non-profit organization the Gemological Institute of America which was founded in 1931. GIA’s goal is to protect diamond buyers from fraud and they created the ‘4 C’s and the International Grading System. When purchasing a diamond it is key that it is accompanied by a GIA report – this will guarantee its authenticity.

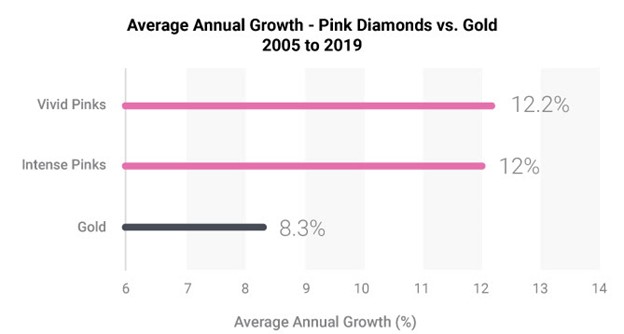

Fancy colored diamonds, specifically pink diamonds, are a far better investment over gold. Even during COVID-19 when many markets faced an uncertain future, the pink diamond market remained stable and were an attractive part of investor’s portfolios. Between 2005 and 2019 the average annual growth of pink diamonds was 12.2% compared with only 8.3% for gold.

At Hard Carbon Inc. we are leaders in the North American fancy colored diamond market. With decades of experience we work closely with investors to obtain the best diamond to match their investing ambition. All of our diamonds are GIA certified and due to our extensive network both in Canada and the U.S. not only do we source diamonds for purchase but we also assist our clients when they wish to sell.

If you are interested in investing in the dynamic world of fancy colored diamonds give us a call today to get started on this lucrative journey.